Methods for valuing data

Last Updated November 26, 2018

Brief descriptions are provided for methods that data producers, hubs, and users can use to assess the economic value of data (Table 1). Links to full descriptions are provided for each method.

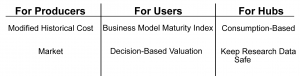

Table 1: Data valuation methods for producers, hubs, and users.

Data as assets

Data are raw alphanumeric values obtained and owned by data producers. When a data producer uses data for operations, they can be treated as physical assets. There are mature methods for assessing the value of physical assets. When data are used for other purposes (decision-making, regulatory, and research) they often are treated as intangible assets. These assets are more difficult to value and the methods are less mature and less precise.

Unlike a ‘typical’ asset that provides value to the organization that owns it, data also have immense value for secondary users creating value for multiple organizations for multiple purposes at the same time. Here, data behave as a derived asset (or non-rival good) whose value is tied to an end use. Methods for valuing derived assets are in their infancy.

Data producers: Valuing data as physical or intangible assets

Data producers may treat data as either physical or intangible assets, valuing data based on collection costs or their users’ willingness-to-pay for the data.

Modified Historical Cost method

The Historical Cost method assumes that data producers behave rationally and will only spend the money needed to acquire an asset if they will receive at least an equivalent economic benefit in the future. The method assumes a return on investment (ROI) greater than or equal to 1. Data range from potentially having no value to enormous value. For example, some organizations collect data first and decide how to use them later. As a result, sometimes data are never put to use and are only a cost. At the other end of the spectrum, data may be used to inform high impact decisions, resulting in the data being far more valuable than their acquisition cost. Not all data are created equal.

To address these limitations, Moody and Walsh (1999) created the Modified Historical Cost method. This method adjusts for the value of the data based on the unique attributes of data, such as the potential for an infinite number of users, the quality of the data, and that duplicate data have zero value.

Market methods

Market methods look at the willingness-to-pay for data and are particularly useful in instances where data (or information) have, or could become marketable. Here, the price data users are willing to pay reveals the value of the data. In instances were data are free, such as public data, the value is estimated by how much data users state they would be willing to pay. Market methods only consider the willingness-to-pay and not the value created once the data have been put to use. These methods may also be used by data hubs, particularly if they also produce data.

Data users: Valuing data as derived assets

Data users treat data as derived assets with methods that link the data to the value of the decision being made.

Business Model Maturity Index method

The Business Model Maturity Index method assesses the value of data used to inform new business initiatives. This method starts with a quantifiable (financial, water savings, etc.) desired outcome and assesses several use cases that could lead to the desired outcome. For each use case, the relative importance (from 0-no value to 1-critical value) of the data to realizing the full potential of the use case is estimated using expert opinion. The value of the data is proportional to their contribution to the use case.

Decision-based Valuation method

The Decision-Based Valuation method is similar to the Business Model Maturity Index method, but also incorporates data’s attributes into the valuation process – such as its quality, timeliness, and the level of effort required to transform the data into usable information.

Data hubs: Valuing hubs as data repositories

Data hubs are difficult to value because they facilitate the flow of data between producers and users and may not have a sense for the cost of data collection or for how the data are being used. Here, we explore methods that are being developed to work around these challenges.

Consumption-based method

The Consumption-Based method essentially adapts the Modified Historic Cost method to data hubs. The method assumes the hub’s value is equivalent to the cost of acquiring the data from producers and then adjusts the value based on the number of downloads by each user or by data purpose. The value of the hub can also be adjusted to account for data quality and the frequency of updates.

Keeping Research Data Safe method

The Evaluation of Cost Models and Needs & Gap Analysis report discusses 10 cost and benefit models that attempt to value the management of digital assets. The Keep Research Data Safe (KRDS) method was found to be the most comprehensive: accounting for the cost of users to access resources, improved efficiencies, willingness-to-pay, and the value derived from use cases. This method also allows data hubs to consider long-term economic vitality by accounting for depreciation/amortization and discounting of hardware. Limitations to the KRDS method include the time needed to build the model and the flexibility in choosing how to weigh different benefits creates uncertainty and difficulty comparing between hubs.

Return on investment and benefit-to-cost ratio

Organizations looking to make a business case often need to report the return on investment (ROI), which is the benefit divided by the cost. ROI is useful for comparing costs and benefits that accrue to a single entity. However, when the benefit of data accrue to different organizations it makes more sense to discuss the value of data in terms of a benefit-to-cost ratio.

For more information:

- Bergie, N. and J. Houghton. 2014. The Value and Impact of Data Sharing and Curation: A synthesis of three recent studies of UK research data centres.

- Glue Reply. The Valuation of Data as an Asset.

- Kejser et al. 2014. D3.1 – Evaluation of Cost Models and Needs & Gap Analysis. European Commission.

- Moody and Walsh. 1999. Measuring the Value of Information: An Asset Valuation Approach. European Conference on Information Systems.

- Pearce, D.W. and Ece ?zdemiroglu. 2002. Economic Valuation with Stated Preference Techniques: Summary Guide. Department for Transport, Local Government and the Regions.

- Smarzo, Bill. 2017. Determining the Economic Value of Your Data. Strata+Hadoop Make Data Work Conference.

- Stander, J.B. 2015. The Modern Asset: Big Data and Information Valuation.